I attended a presentation hosted by the BCS, and given by Ron Ballard, based on his article in IT Now, “Blockchain: the facts and the fiction”. What he said inspired some thoughts and reminded me of others, some of which I have previously published on my blog. I wrote an article, called Learnings of Bitcoin, which was meant to be a spoof on the Borat film title and posted it on my linkedin blog, The article looks at the tight coupling of Bitcoin, and its consensus mechanism, the proof of work, together with its costs and vulnerabilities. It examines the goal of eliminating trust authorities and its questionable ability to meet the necessary roles of money as a means of exchange and a store of wealth. In the comment pushing it, I say, "This might be a bit basic for some, but you can't have a coinless immutable blockchain, at least not one based on 'proof of work'.", at which point you need to consider if there are better data storage platforms for your use case. I use more words to explore these issues below/overleaf ....

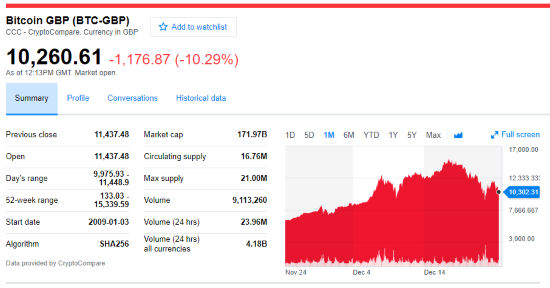

There’s no divorce in Bitcoin