In my linkedin article on Banks & Customers, I started by talking about the workshops at Citihub’s World Conference which had posed a 10 year time horizon. Medium term horizons such as this are both liberating and challenging when considering the future of banking and business it is certain there will be massive change and since finance has been the first business to digitise, the future of ICT is a key influencer. I also received a post from Chris Skinner’s blog, “Banks face more change in the next 10 years than in the last 200”; my response on banking is encapsulated in the linkedin article, but what makes Chris’s blog article so interesting is the illustrations about how hard it is to predict the future. For instance he posts a Jetson’s style picture, created in 1966 forecasting the state of science/life in 1999. While we have some moving walkways, they are hardly ubiquitous and much of what they suggest might come to pass has not. We do not have rocket belts, city wide domes, hovering vehicles, nor flying saucers. Looking at these forecasts provoked me to look at “Blade Runner” and its inspiration, Philip K Dick’s 1968 book, “Do Androids dream of Electric Sheep?”. “Blade Runner” was made in 1982, and set in 2019, Dick wrote the story two decades earlier and set the story in 1992.

The film makes much of the existence of space flight, off world colonies and perfect humanoid (and other animal robots) which all seem to be unlikely within the next four years, but even so we are still missing the guns and flying cars but not the prevalence of rain and sushi. One of the reasons these changes are so far from the mark, is that the big bet on space travel was wrong; humanity built the internet instead. I have missed, of course, that the film is set in LA and so the rain must be symptomatic of climate change; LA Story it’s not.

Further interest around forecasting from Skinner’s article is found by his pointing at Long Bets and his selection of a number of IT predictions. Long Bets is itself a betting exchange, and some of its predictions are fairly ordinary, many are either financial or political. (I quite like the idea that exec{“helloworld”} will take a gigabyte of space and that Chelsea Clinton will become Queen of England and the USA). Skinner chooses to comment on six bets, and the score is two right, and four wrong. Netflix exists, and so does the Panoptican and that is 10 years early. We are not printing books on demand, we are streaming them, Russia is still not the world’s foremost software development centre, there is no consumer travel to the Moon, and we are some way from the prediction that there will only be three significant currencies used in the world. (US Dollar, Bitcoin and Spacemiles). However since the forecaster predicts this will occur by 2063, we have some time to go, but the dollar’s survival to 2063 would seem an evens bet today if you are a fan of Zero Hedge.

At the conference I tried to sum up, in my mind, the technical change over the last 10 years. 10 years ago having a customer portal was a big deal, distributed computing was hard and mainly in the hands of academics, and of course, the military. Google undertook its IPO in 2004, Apple launched the iPod, the most pervasive computer operating system in the world was the 32 bit Windows XP and the most current CPU chip was the Pentium M also 32 bit, although Intel/HP had launched Itanium and other RISC chip vendors had had 64 bit computing for a while. Today the most pervasive operating system/UI is Android, the most pervasive CPU architecture is ARM. The standard system architecture was shared memory, uni- or multi-processor, Compuserve/AOL was the biggest social network, today it’s gone and dwarfed by Facebook, Twitter and iTunes, consumer connection to the internet was via dialup and isdn was only just becoming available in 2004, LAN speeds have grown from 10 GBE to 100 GBE.

| 2004 | Technology | 2014 |

| CompuServe/AOL | Social Network | |

| Bespoke | Portals | Ubiquitous |

| Niche | Distributed Computing | Ubiquitous |

| Shared Memory (UMA) | System Architecture | Cloud Grid |

| Client Server | Server Collaboration Architecture | Cloud Grid |

| Windows XP | OS | Android |

| Pentium M (32 bit) | CPU | ARM |

| Storage Networks | Storage | Hadoop |

| 9.6 baud dialup | Internet Connection | 100 Mbs |

| 10 GBE | LAN Speed | 100 GBE |

| Search | Mobile Phone | |

| iPod | Apple | iPhone/iCloud/iTunes |

| Private ($54) | $350 bn ($510) | |

| $1.52 | Apple | $115 |

The last 10 years has been a story of miniaturisation, consumerisation and collaborative computing.

I.T is now much cheaper and distributed i.e. multi-system solutions are replacing the shared memory SMP systems. Software architectures are post client-server. Given this, maybe it’s right to summarise the recent history of I.T. as the evolution of Netflix and its competitors; it is a distributed network attached system using modern scale out storage and massive scale. They are exemplars in the practice and development of distributed, open-source and cloud computing and the ultimate network consumers. They at least have innovated their markets and thus brought value to their customers. They are also massively inhibited by competition from their supply chain; which is one reason they are diversifying into content creation.

When looking at the corporate landscape, as Simon Phipps observed the IT vendors are all changing up, “IBM is becoming GE, Microsoft will become IBM, Apple is becoming Microsoft, Google will become Apple”. While it depends on your views about corporate consolidation, this all leaves room at the bottom of the scale for software and social innovation. The barrier to entry for software production is relatively cheap but only if soviet style cloud or the alternative p2p models allow access to cheap IT; someone still has to pay for the chip fabs and power.

I personally think the next 10 years for IT will be about adoption not dramatic change.

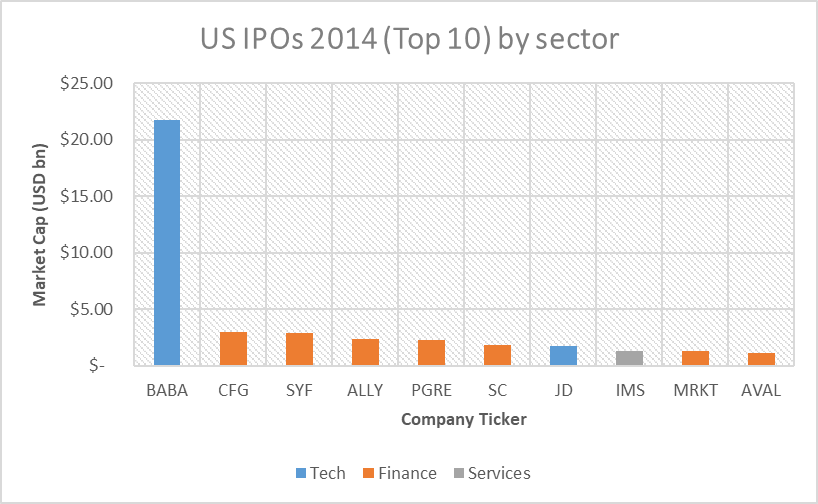

I am unclear if the IPO activity last year confirms or agrees with me. In an article published on Forbes, called Technology:Is there an IPO Boom? 2014 IPO Statistics, by Sahir Surmeli, it is shown that 7 of the top 10 US IPOs were Financial Services firms.

They were all dwarfed by Alibaba and the chart above is derived from the Forbes article. Is this further evidence that innovation is no longer in Technology?

This article was written over 2015; I didn’t publish it because I wasn’t sure it said anything useful. In 2021, I went to a seminar that asked for a 20 year forecast and it reminded me how I felt that little had changed in the 10 years up to 2014. I have backdated the article to about the date I finished it. …