I was considering the EU’s NextGenerationEU and the idea that this was the tipping point into a fiscal union. I am not sure because the EU’s tax raising powers are as pre 16th Amendment United States; it cannot tax people or companies. This led me to consider the proportion of Govt. income rasied through income tax and other sources. This is a blog in two part, the first on the EU & the 16th amendment, the second on UK income tax and income equality. I comment on direct taxes and and the 16th by writing the following,

While looking at EU common tax policy, I thought about the need of the US to pass a constitutional amendment to allow federal direct taxation since previously the US required direct taxes to be apportioned to the States. The amendment is the 16th, and was designed to permit Income Tax an overcome a Supreme Court ruling which prohibited it; which came in two years later and has never been repealed. The Constitution Center has a review of the amendment arguing that the 16th only authorises income tax and the court has for instance constrained capital gains taxes. The Atlantic, also comments although the latter is more a history.

Dave Levy

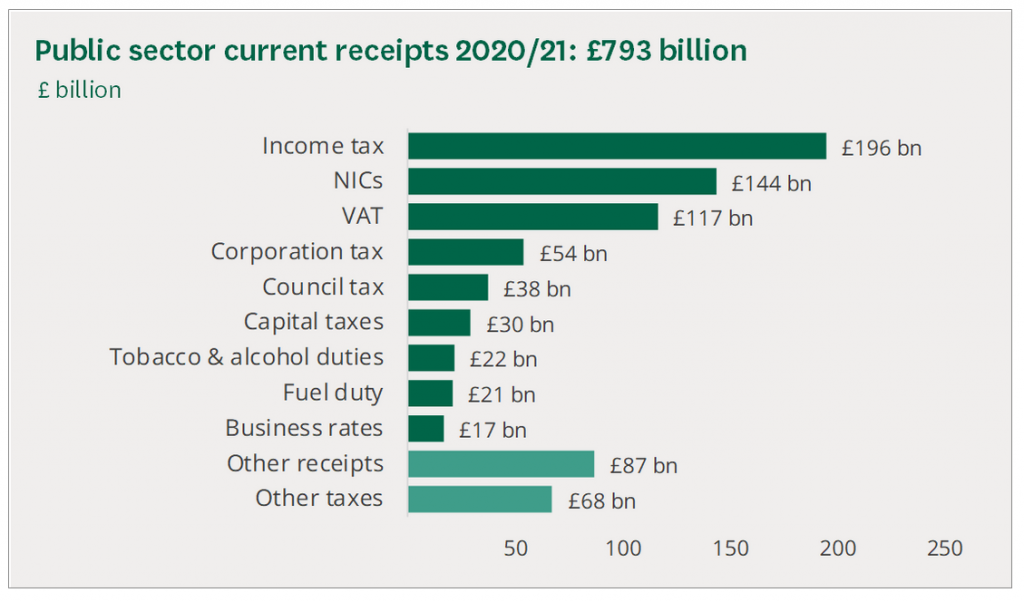

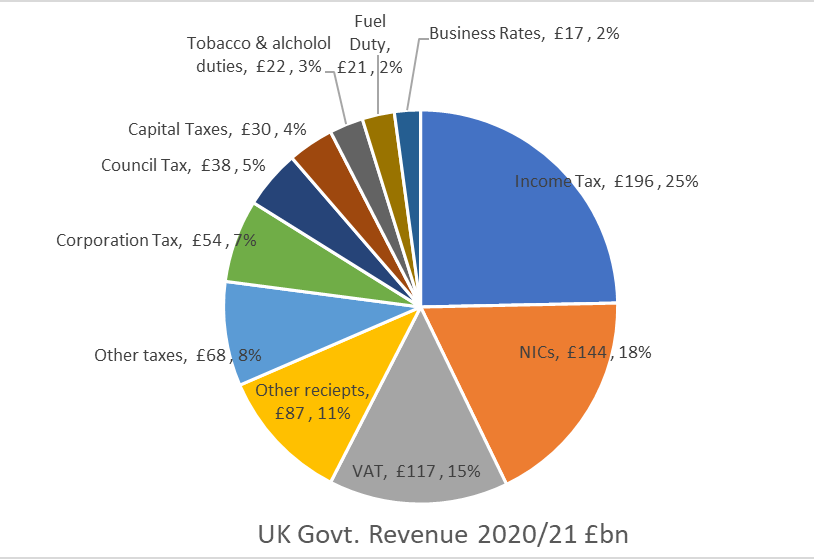

The obvious development of income tax within the US led me to have a look at just how much of the UK Govt’s income is raised through income tax, the most progressive tax we have. The House of Commons Library has described the 2020/21 tax revenue sources, it seems that they’re no longer posting it out to everyone.

The report landing page also has a chart showing the proportion by source over time, and its remarkably consistent. I also note that Income Tax is separated from NI and while some NI is paid by the employer most is paid by the employee. The Govt gets 43% of its income from these two sources and on top of this charges 20% of what one spends. There is also a compulsory private sector pensions levy on workers too, which does not appear in this chart. No wonder the low paid are struggling.

The separation of NI from Income Tax also permits them to claim that “The 10% of income taxpayers with the largest incomes contribute over 60% of income tax receipts”.

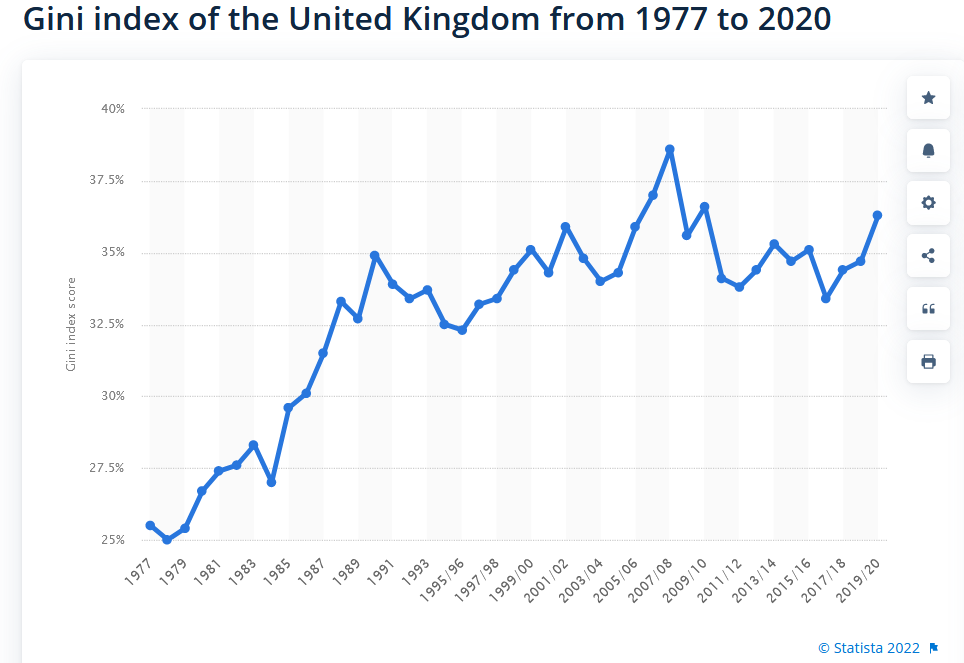

If you want to look at income inequality, Statista have the Gini Coefficient over time.

We need more income tax, less NI & VAT

This article contains Parliamentary information licensed under the Open Parliament Licence v3.0. The featured image is from Images of Money, on flickr, via wikimedia.org and used under the Creative Commons Attribution 2.0 Generic licence. …