I have written an emergency motion for Labour Party Conference, I have ’till noon on Thursday to get it submitted, so better get a move on, unfortunately doing this from a CLP is a bit tricky . I need to check if it’s on the Agenda but that’s a bit tricky, I am not sure they have published all the motions to hoi-polloi like me yet.

Conference notes the announcement by Liz Truss on 19th September that there will be no post Brexit trade deal with the USA, and that the Govt is once again postponing (16th Sept) the imposition of the agreed customs checks between Great Britain and Northern Ireland.is a bit tricky, made worse by the direction not fo

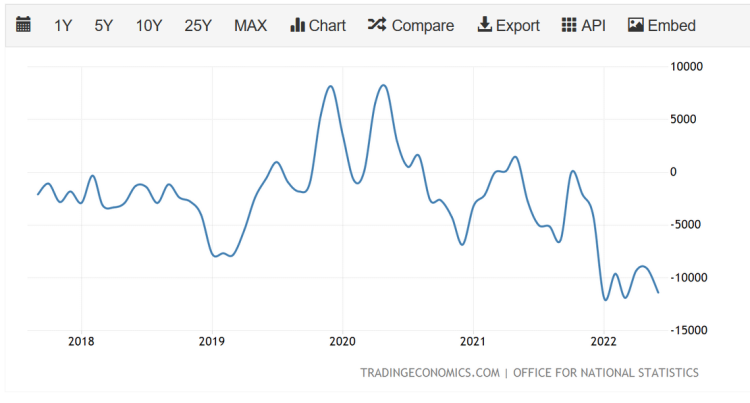

Conference further notes that the Tory ‘Hard Brexit’ has led to reduced foreign inward investment, a worsening balance of trade deficit, reduced employment, a labour shortage in many industries, most obviously in agriculture, hospitality and in the NHS, jobs are being offshored to western Europe and sterling is at its worse exchange rate ever with both the dollar and the euro. The labour shortages are compounded by the xenophobia released by the referendum and the Tory’s “hostile environment”.

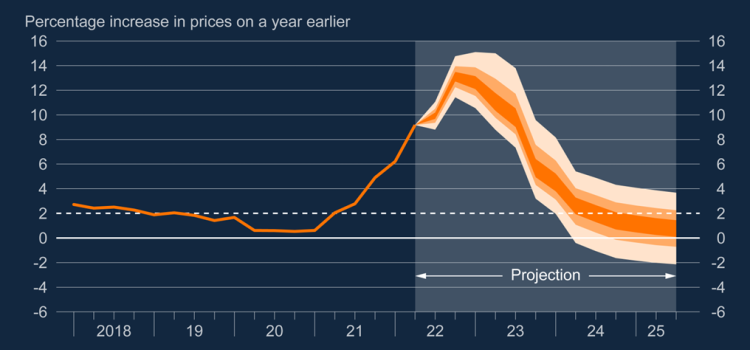

Conference believes that these negative economic consequences of Tory policy are significant contributors to the cost of living crisis.

Conference believes that to start reversing the damage inflicted by the Tory ‘Hard Brexit’ Britain needs to significantly reduce the trade frictions it has imposed on its imports of goods, services and labour from its biggest trading partner, the EU.

Conference resolves that Labour will call for a closer relationship with the EU in order to alleviate the trade frictions the Tories have introduced, that we will seek to rejoin Horizon Europe and Erasmus+, and that we will repeal the cruel and intrusive hostile environment. …