Like many, I am considering the macro drivers of the cost of living crisis and I listened to the AEIP podcast with Gary Stevenson. He has an interesting view and argues that the QE funded furlough scheme was in fact a subsidy to the rich and that the fundamental imbalance in the country is the shift of wealth from poor to rich. It’s a version of the argument that the problem is insufficient demand being caused by the continued pressure on medium and low incomes.

He also argues that the massive QE efforts are an effective devaluation which given the relative stickiness of prices with wages being the slowest to change and everything that wages need to buy increasing will exacerbate the squeeze on spending. He also argues that given the choice between working and starving, people will work. The use of the word devaluation led me to look at the following charts

The pound has been falling against the dollar all year, this makes imports, particularly of Oil, but also of Gas and food more expensive.

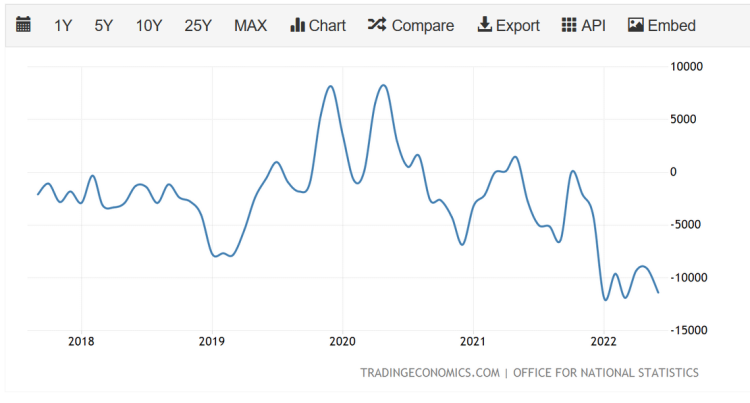

Here we see the balance of trade figures, a more traditional cause of devaluations. With the exception of two months, the UK has been in deficit for the last five years. There are those who contest the the balance of trade causes currency price movements and Sterling in particular is impacted by speculative currency flows. The key drivers of speculation are expected rate of return, which for fixed income assets is driven by the bank rate, and animal spirits about which I think it best not to comment.