In an article on CNBC, with an article entitled, Bank of England’s Haldane warns on inflation; bond yields move higher (cnbc.com), they summarise the article, “In a recorded lecture, Haldane noted that there were both upside and downside risks to the inflation outlook, but cautioned that an inflationary “tiger” had awoken. … Global markets have been jittery over the past week due to a spike in the U.S. 10-year Treasury yield, driven in part by rising expectations for inflation and economic growth. …

Earlier this week, U.S. Federal Reserve Chairman Jerome Powell sought to temper concerns that the Fed would tighten monetary policy conditions in the face of rising inflation. Haldane is seen as a long term hawk on interest rates, and I add the critical question to ask is why now? Although for monetarists, the increase in QE, and the synchronous reduction in real goods/production caused by the slump might be one explanation but they can’t explain why we’ve had ZIRP for the last 12 years. I know that technically ZIRP is the interest rate and a policy input and inflation is the change in prices (ΔP) which may or may not be a policy outcome. The fact is we do not know if bond yields increasing is right or not i.e. if this is a result of market fundamentals or if the US Bond yield rises are a statement of confidence in the US government. The markert determining the US T-bonds need a risk premium would be potentially catastrophic.

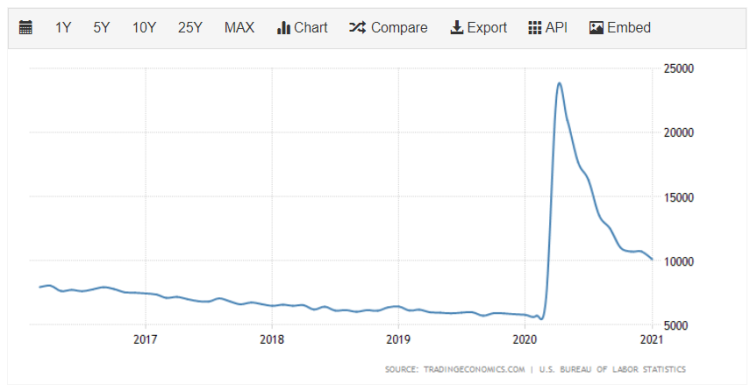

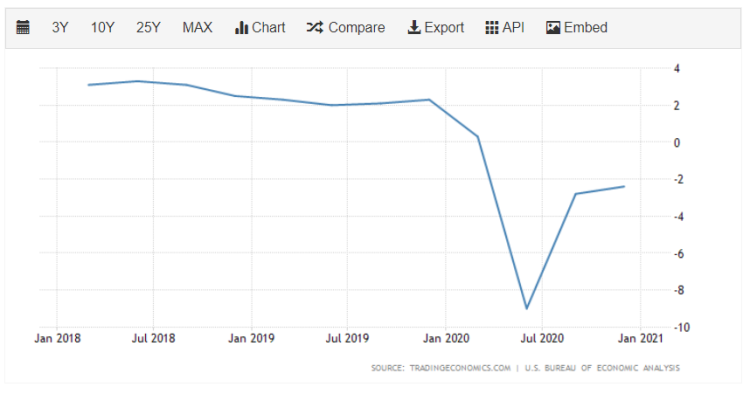

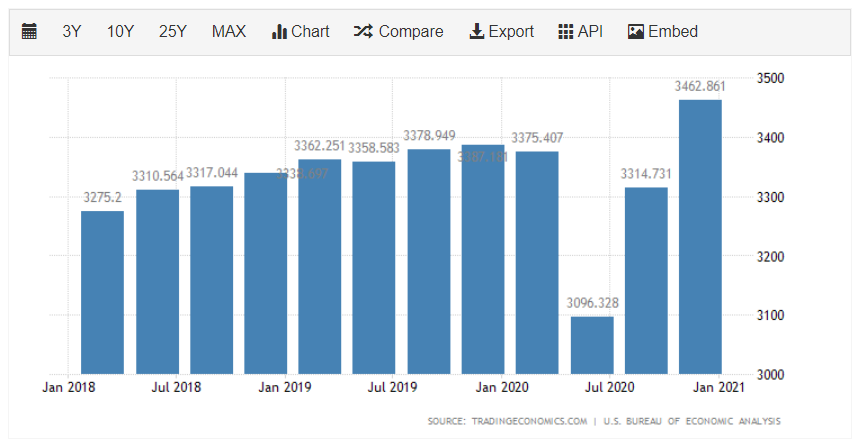

This article, Warning: the Bond Market is Starting to Blow Up Again, at ZeroHedge, is a bear market broker’s advert for investment advice, but has two very interesting charts, showing, that yields have been higher recently and that there is massive room in the US real economy to take up the slack. It also suggest that the spike in yields may have been caused by the Chinese Central Bank’s psyops. In my eyes, the real economy, suggests that inflation is unlikely to reoccur soon, as shown by the levels of unemployment and a heathy (or at least a not unhealthy) fixed capital formation; however, Haldane is reciting the bourgeoisie’s favourite mantras, inflation is coming, we need to increase interest rates, although in the UK that would just increase the govt’s cost to borrow, in theory. In reality, changes in market yields does not impact the interest paid by the govt., it impacts the prices of issued bonds.

This is just fear mongering isn’t it?

Danny Blanchflower doesn’t agree with this. The likelihood of inflationary pressures when there is significant unemployment is very low. The furlough scheme is essentially hiding large scale unemployment such that the current rate of 6.5% is unreflective of the fundamentals. Once the furlough scheme ends (Sunak in the budget has set it up to slowly implode) then unemployment may head towards a more real number of 13%+. Inflation is unlikely when there is such a high rate of underutilised resources in the economy. There is of course also Brexit as the TCA thanks to the NI protocol seems to be slowly unravelling.

Probably you are right that Haldane is just reflecting monetarist obsessions and a concern at the money creation through QE that has taken place. Learn MMT and a lot of these worries fall away.