A couple of years ago, I wrote a precis of the McKinsey Quarterly article, “Distortions and deceptions in strategic decisions”. They started with a review of the way human bias can adversely impact strategic investment decisions illustrating it with a story about a mega-merger which failed. They conclude the article with,

Companies can’t afford to ignore the human factor in the making of strategic decisions. They can greatly improve their chances of making good ones by becoming more aware of the way cognitive biases can mislead them, by reviewing their decision-making processes, and by establishing a culture of constructive debate.

The first half of the article examines the propensity to optimism vs. perceptions of loss aversion and argue that portfolio management is a better way to evaluate the risk as lossess can be compensated by other success. I believe though that British management and particularly public sector management is very risk adverse; there is a higher fear of getting things wrong than getting things right although how we end up with Universal Credit, the Boris “vanity lard bus”, his water cannons and his other “erections”, I don’t know.

What made me remember the article was it’s listing of what they call tools to isolate any human bias to me most importantly

Another technique is to request that managers show more of their cards: some companies, for instance, demand that investment recommendations include alternatives, or “next-best” ideas.

I wonder how many of these lessons need to be applied to local authority planning decisions. Check below/overleaf for more …

ooOOOoo

I have made a diigo bookmark and high lighted snips from the article.

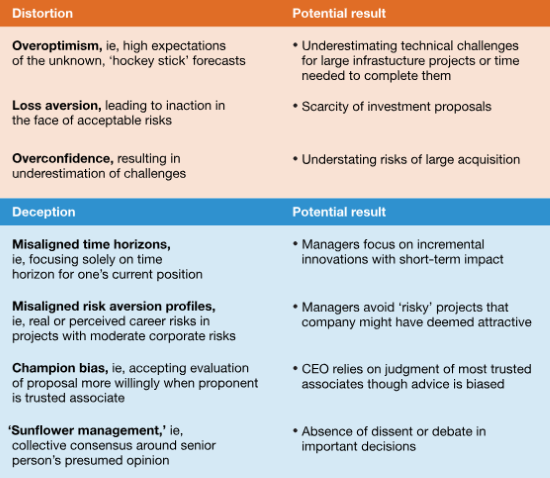

Here is a graphic from the article illustrating the bias and its impact

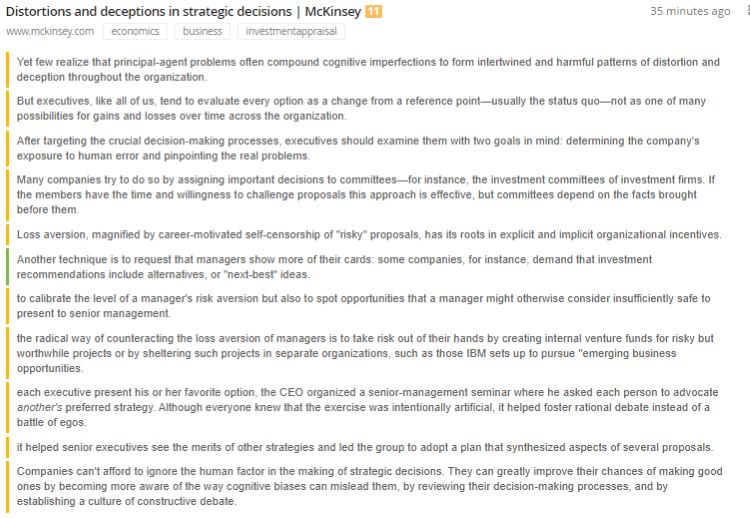

and here is an image of my highlights

I am not surprised I remembered this, looking at my highlights on diigo, it asks questions of one man management and referendums, as well as propose and dispose decision making.

Pingback:What does ‘system update required’ say about Labour’s IT? – davelevy.info

Pingback:Innovation happens elsewhere! – davelevy.info