Some aspects of this are hard to understand, here’s my attempt. The UK has been in a balance of trade deficit for decades. For most countries it is the main factor in determining foreign exchange rate between sterling (GBP) and other currencies. In the case of the UK, there is significant additional incoming flows buying sterling quoted stocks, bonds and gilts. Sterling has been falling ever since Brexit, in my mind as a result of a drop in confidence due to Brexit and the growing relevance of the balance of payments deficit; the fear of inflation has added to that recently.

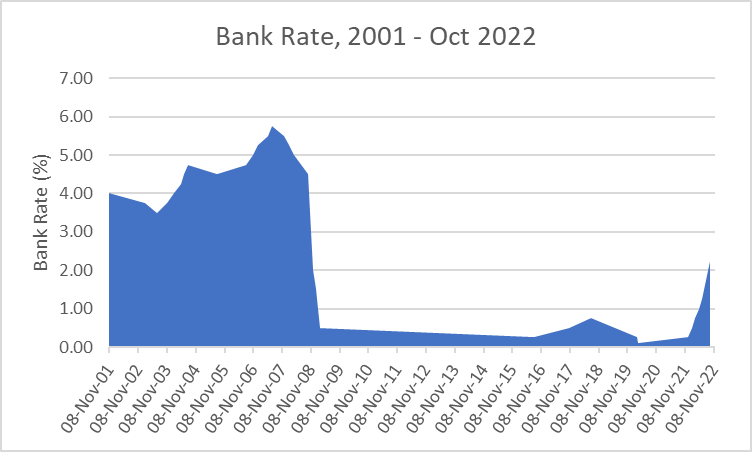

Last month I looked at the cost of living crisis, which I argued was mainly caused by increasing energy and food prices. The Bank of England has raised the minimum lending rate (Bank Rate) as both a counter inflationary measure and last week, a currency market defence i.e. if the US or ECB raise their interest rates then sterling is less attractive as savings location and money moves out.

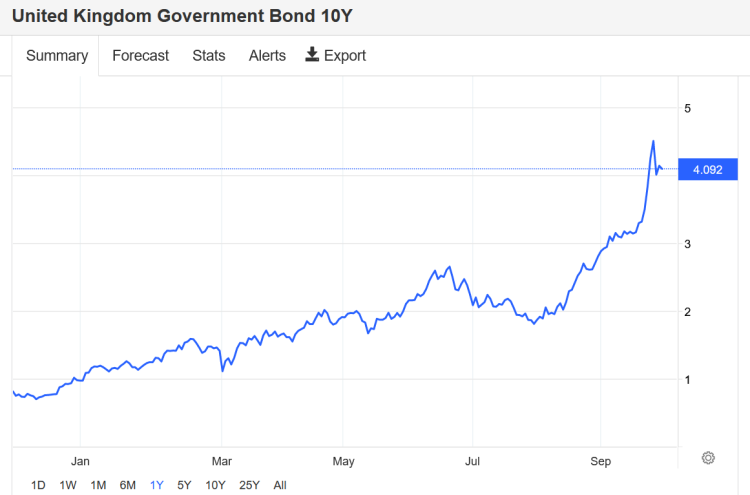

On 23rd Sept., the Chancellor announced a £65bn tax cut, which was aimed primarily at the better off. In doing so he seemingly rejected the advice of the Office of Budget Responsibility. The Treasury select committee have asked to see the advice. The controversial purpose of the tax cuts is to increase domestic income and thus demand for both consumer and investment goods, but in the words of Blackadder, “there is one problem with this theory”. Actually, there are several, but in terms of understanding the current crisis, it is generally believed to be inflationary and its benefits are contested. not least by those who say any tax cuts or subsidy should be given to the poorer who will spend it rather than save. The markets’ response was swift and brutal, sterling and UK long term government debt both fell dramatically in price. This also has the effect of making the funding of the tax cuts more expensive.

There are two technical features of the current UK financial services market that have exacerbated the problem. The first is index linked gilts, these pay a variable rate of interest and redemption payment, depending on the RPI. This has the side effect of ensuring that the markets expectation of inflation becomes a factor in the spot price of long-term bonds. The primary market for bonds is as a savings instrument, but additional bonds are held and traded by hedge and speculative traders. The announcement of a non-credible macro-economic policy caused the markets to fear inflation and dump UK Gilts, and swap or trade GBP for other currencies.

It gets worse, on 28th Sept, the Bank announced a massive gilt buying operation to sustain the price of UK gilts. They did this because of fears of pension fund collapse. It seems that many pension funds have been borrowing and buying derivatives in order to invest and doing so against their gilt assets. Inter-institutional loans require the borrower to post collateral and as the value of the gilts decline, so does the collateral and the lender asks for more. The funds then have to sell a reduced value asset in order to post collateral and the volume of these sales impacts the price in downward direction. Let’s hope the bank action is enough. Even those in a defined contribution scheme, may have problems, as the collapse of the Equitable shows, where it went under because its guarantees to a subset of it investors were seen as more important than its contractual obligations to the rest. A lot of people lost a lot of money.

The Govt is finally talking to the Office of Budget Responsibility and are planning an announcement. The Bank of England is holding fire on announcing interest rate increases, which maybe substantial.

Increasing interest rates will impact mortgage payments, and we move to the world of “the Big Short” with people losing their homes. It will get worse as the period of fixed payments expires. The mortgage providers took fixed rate mortgages off the market. Increasing interest rates will also increase rents as landlords seek to defend their income against inflation and increasing interest rates and of course many rental properties have mortgages to pay.

A triple whammy of inflation, pension losses, and mortgage payment increases, suddenly the UK seems a lot poorer than it was.