In its autumn statement, not exactly hidden, the government have announced their plans to extend sanctions against benefit recipients, included the mentally ill and the disabled, if they fail to look for work. The sanctions scandalously include the levying of prescription charges and prohibition on receipt of legal aid. Labour’s leadership is sadly relatively silent on these proposals. I remind myself that access to healthcare is a human right, as should be access to justice.

Here are some links I have discovered, they include the government’s boastful announcement, where they focus on the increase in expenditure from the low levels that previous statements have created. Rachel Reeves in her reply notes that the overall taxation level is as high as it’s ever been due to changes made in previous years, but her reply does not deal with the issue of sanctions; Liz Kendall’s words are deeply unassuring [and also here last month] for those who consider these sanctions to be a step too far. In the abstract it’s possible to argue that people who can work should work, but it is impossible to build the means by which this can be implemented without simulating the worst of labour conscription programmes from historic totalitarian regimes.

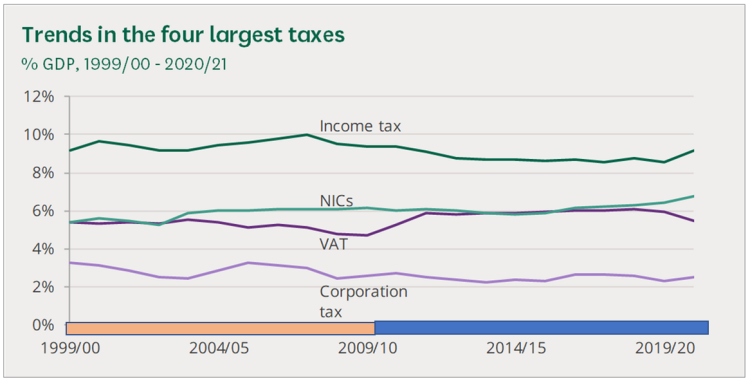

Not only are these rights, I remind myself that once upon a time many of these benefits were funded through National Insurance, and seen and conceived as an insurance based benefit. People or their families have paid for these benefits and even if an individual’s work record and contributions are low, they will have been paying VAT and various other taxes.

All the human rights charters including those that we are still members of require that legal support is provided where it cannot be afforded. Admittedly, this is usually when being prosecuted by the State but then human rights law primarily addresses abuse by the State against its citizens and denying benefit claimants access to legal aid so they can’t sue the government when the break the law is a policy goal of the government.

The UN Declaration of Human Rights & the EU’s Charter of Fundamental Rights express a right to healthcare. The European Convention does not although, they say, case law requires states to safeguard people’s mental and physical well-being in many different circumstances and ensure that people can access the healthcare they need, they have a say in the treatment they receive and they can get justice when mistakes are made.

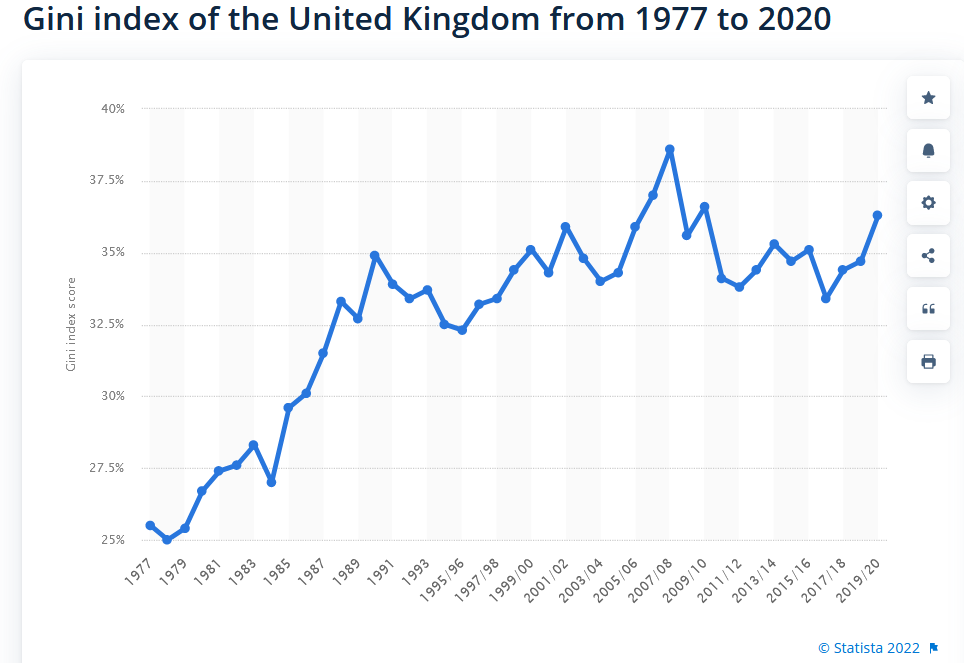

The government and the Tory Party’s contempt for universal rights is one reason why the UN has issued so many adverse reports against the UK and its government. …