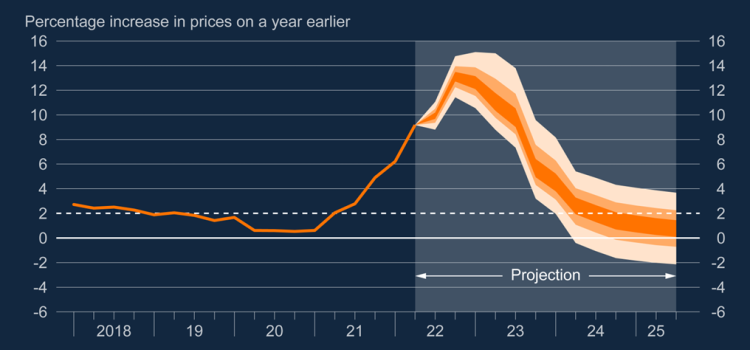

The Bank of England was made ‘independent’ of the Treasury in 1997, although not really, so that it could take the blame for any decisions to increase interest rates, such as those taken earlier this week (£) when the Bank increased bank rate to fight inflation.

How does that work? Inflation is believed to have one of two causes, one is that there is too much demand, chasing too few goods and consumers bid up prices. The other is that import prices are rising and thus have an impact on the domestic price level. These are known as demand-pull, or cost push. The current inflation would seem to be caused by the increase in the cost of imports especially primary energy products, exacerbated by a fall in the exchange rate.

The monetarist theory is that there is a real world and money view of the economy.

i.e.

Prices x Product = Money Supply x Velocity of Money

PQ = Mv

This equation is derived via definitions and algebra and thus there is no proof of causality. Monetarists say that reducing the money supply will reduce prices. This assumes that in the short term both the velocity of money and the amount of product are static. Recent econometric studies suggest that the velocity is not constant, and there has always been a problem of defining what money supply is as it must include some credit and so is very difficult to constrain. We should note that consumer credit can be increased very rapidly so can no longer be consider static.

There can be no doubt from studying economic history, that increasing interest rates to reduce the money supply causes a recession, unemployment and poverty. It’s also highly likely that unionised workers will demand higher wages to defend their living standards. In a world where business is internationally mobile, business will defend its profits by increasing prices and/or off shoring the work; this is the wage-price spiral where an economy has high inflation, both cost push and demand pull and low growth.

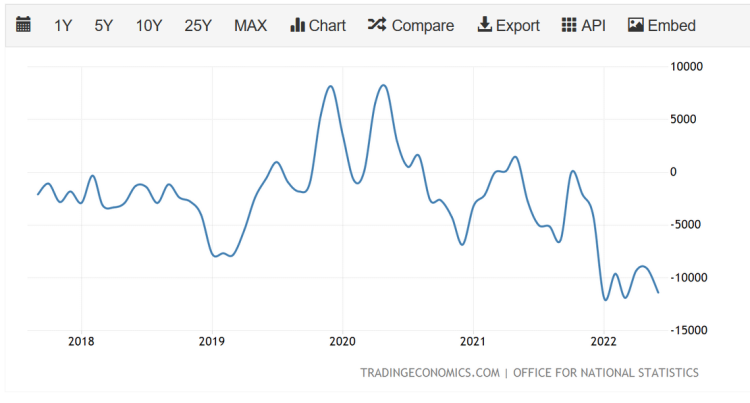

The drivers of growth and/or the floor to a recession are investment, exports or government expenditure, especially benefits. Increasing interest rates makes investment and the national debt more expensive. It makes exports cheaper in their foreign markets but of course the big factor in the export price uplift is Brexit. Higher interest rates increases the income on savings and the expense on business and domestic borrowing. A squeeze on profits will cause capital to go overseas, especially if the exchange rate is high although this may be ameliorate by the increasing yield in bonds. The other cause of the economic malaise is the poor investment rates by both the private and public sector in the UK.

There can be no doubt that increasing interest rates will cause unemployment. This is how it reduces demand.

The other option to monetary policy is product supply, direct investment such as the EU’s Horizon Europe programme or price regulation to cause a profit squeeze, tax the energy companies and banks, build more houses, control profits, transfer income from the wealthy to the poor because the poor spend more of their income and of course rejoining the EU’s single market to reduce both import and export frictional costs.

High interest rates are a choice, a choice of theory and a choice of policy. The inconvenient truth is no-one knows if it works.

ooOOOoo

I conclude with some links to key commentators, professional economists. David Blanchflower, writes in the New Statesman, “The Bank of England is recklessly driving the UK into a deep recession”, he warns of the threat of unemployment, elsewhere on his twitter feed he is highly critical of the Bank and its Governor, Andrew Bailey, He is also quoted in a video clip by C4 on twitter, stating that unemployment hurts people more than inflation, which can be seen to be a declining threat. Anne Petifor exposes the role of the global capital markets in ‘managing’ food and energy costs, Richard Murphy provides a modern monetary critique of the theories. I particularly like his calling out of the role of import prices and speculators,

There is a third reason why the BoE policy will not work. It’s not just the assumption that people have too much to spend that the BoE get wrong. They have actually totally failed to identify the proper cause of this inflation.

The inflation we’re suffering is the result of shortages of oil, gas, fertiliser and food, in the main. Some of these are real (food, in particular). Others are being stoked by speculators who are profiting from them, which is why oil companies are declaring such big profits now

Richard Murphy – On Twitter

The featured image has been taken from Blanchflower’s New Statesman article where he asserts its a BoE MPC authored chart. This I assume can e used under the OGL license. …