Why do the pension funds have to post collateral on their LDI portfolios?

- Liability driven investments by Investopedia

- Leverage in LDI, a wonderful-servant, a-terrible-master by NN Investment Partners

- Collateral Fundamentals by icmagroup, dated 7 11 2012, a ,pdf

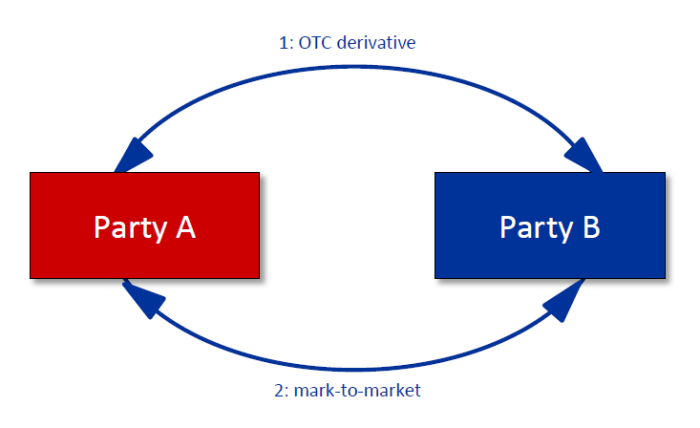

From Collateral Fundamentals, “OTC derivatives trades start from a position of zero value, but over time mark-to-market value will accumulate to one of the parties. Collateral is used to mitigate that party’s risk (i.e. counterparty credit exposure).” and …

• Mark-to-markets is actioned periodically (preferably daily)

• As profits and losses on the derivative contract change, the collateral must be increased/decreased accordingly

• Whilst two way credit support is preferable there are agreements where collateral is only required on a one way basis (eg if B owes A and not vice versa) Collateral: OTC derivatives

Common OTC derivatives are: Interest Rate Swaps (IRSs), Forward Rate Agreements (FRAs), equity

derivatives and bond derivatives. For more see, Derivatives at Finance Strategists, a non-profit educational organisation.